There has been no better vehicle for the middle class to build wealth than Real Estate over the last 50 years in America. This is become such common knowledge and wisdom, that it’s almost not stated anymore. It’s just not newsworthy to point out that the grass is green and the sky is blue. To that extent, it’s almost been forgotten knowledge, which this article intends to rectify. That might seem like a far-fetched concept, that something can be so obvious, it does not get stated, and it then gets forgotten but in actuality our language & culture are filled with these.

For instance:

- Minding your Ps & Qs – meant keeping track of how many pints & quarts of beer you have drunk

- Or traveling “posh” is actually a reference to traveling from England to India Port Outward & Starboard Home, where you get the breeze each way.

- Getting the shaft (New Orleans based), raining cats & dogs, passing with flying colors – are all examples – just email me.

But I digress, a lot, lol.

Instead, the news focuses on new trends like the decreasing trend of homeownership among millennials due to student loan debt, or Air BNB, or whatever the flavor of the month is.

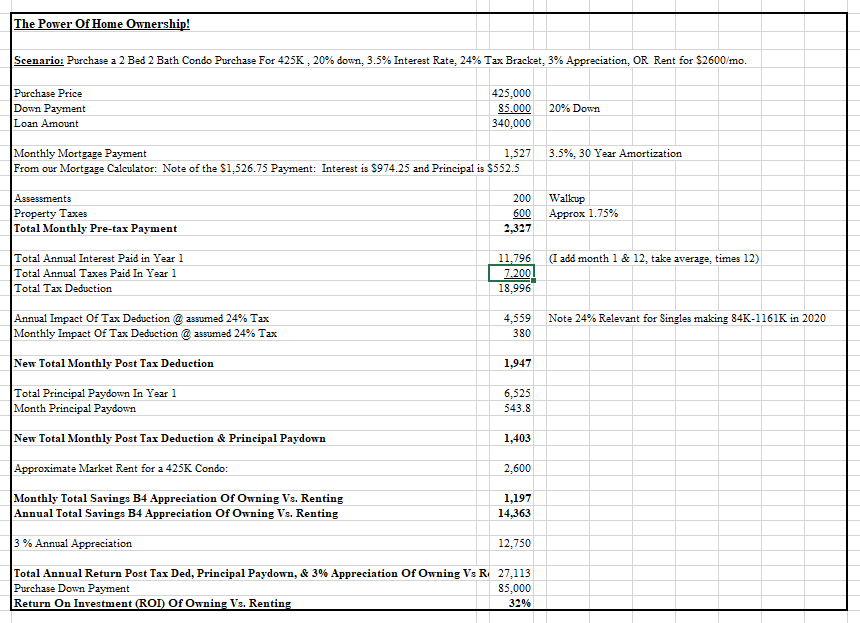

The problem with understanding the full economic of real estate is that with Real Estate, you make money over three different time periods so the total impact is not obvious:

- Positive cash flow or reduced expense: Monthly in cash

- Mortgage interest expense & property tax (10K cap now): Annually in reduced income taxes

- Principal pay down & appreciation: When you sell or refinance